Americans worry about credit card fraud more often than any other crime

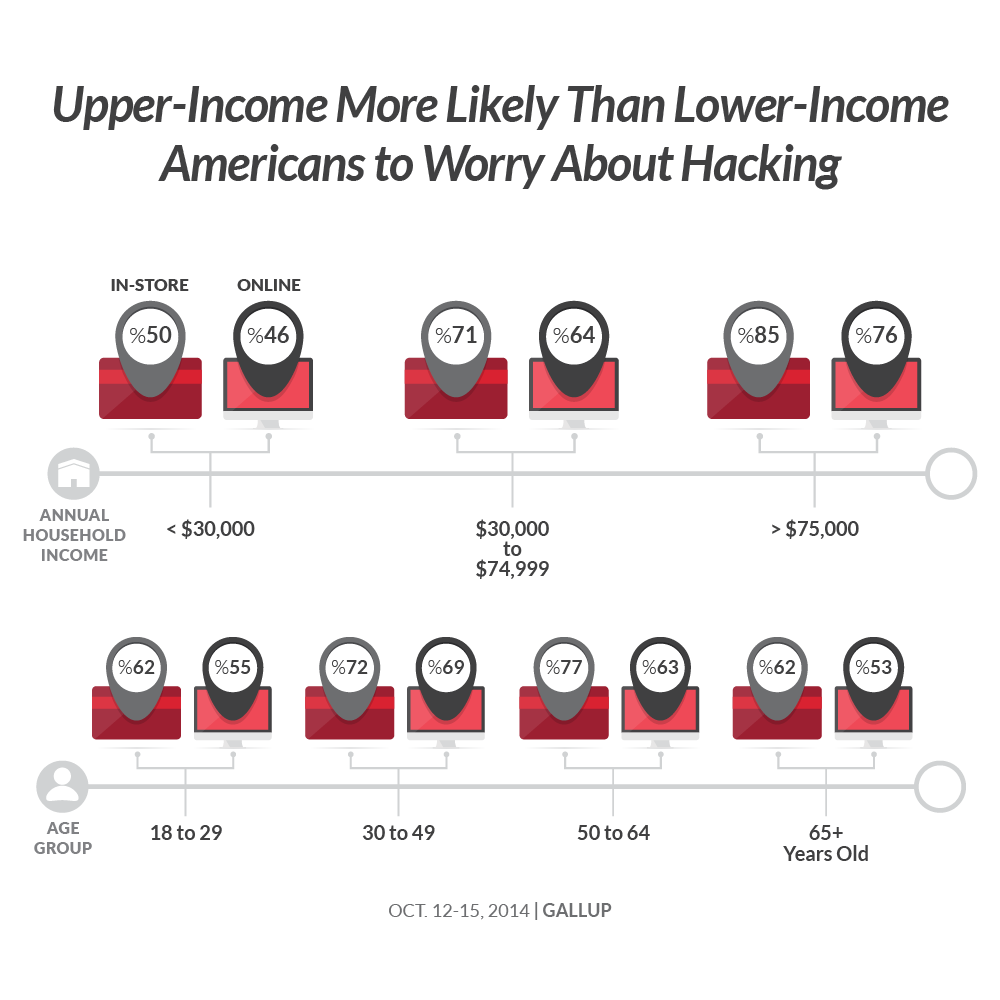

With credit card breaches ever rising, consumers are taking notice—and they’re concerned. In a recent polls by Gallup, 69% of Americans worry about having their credit card info stolen. Next in line? Having their computers or cell phone hacked. And upper-income Americans are the most worried by far.

The fear is justified. More than 25% of Americans say they’ve been hacked, and 27% say someone in their household had stolen credit card information used at a store last year. The majority of these crimes, despite them being the most concerning for Americans, never get reported to police because the banks don’t find the victims responsible.

The more breaches that occur, the more concerned Americans are becoming which could lead to trends in changing consumer behavior. A survey by The Associated Press and GfK Public Affairs & Corportate Communications after the Target breach found 37% of people used cash more often because of it. Since then, Michael’s, Home Depot, P.F. Changs, Sally Beauty Supply, Neiman Marcus, and others have been hacked, causing consumers to increasingly favor cash purchases. Since then, that number has grown particularly amount higher earners with 42% of consumers making over $75k/year saying they’re more likely to switch to cash. Additionally over the past four years, credit card balances in general have declined, furthering the belief that many people are favoring cash purchases.

Will more data breaches mean a majority of consumers using cash? Not necessarily, but it’s notable that these breaches are impacting consumer behavior, since the fear is that people have become numb to data breaches. Any evidence that consumers understand the seriousness of these breaches is definitely good news.

There are things that can be done, however. The transition to EMV will likely contribute to a reduction in fraud, and industry experts are praising tokenization technology as another barrier against credit card fraud. Data breaches are rising, but with new technology, it certainly doesn’t have to stay that way.