A Fleet of Reissued Cards Is Coming—Here’s How to Make Them Update Themselves

Following the Target breach, 17.2 million credit cards had to be reissued to consumers across the country. The FBI has been warning of more breaches coming to light in the near future (Neiman Marcus, Marshall’s, etc.), so it’s pretty safe to assume that there will be more mass credit card reissues in 2014. Additionally, as more credit card issuers transition to chip-in-PIN technology, we’ll begin to see new cards popping up all over the place.

This will be an inconvenience for consumers that either have auto-pay set up or simply allow merchants to store their account information for future purchase—particularly common in e-commerce, memberships, and utilities.

Many consumers love the option of auto-pay. People set up auto-pay for everything from utilities and car insurance to magazine subscriptions and donations. For the consumer, it’s one less thing they have to think about. For the merchant, it assures them that they won’t receive a late payment and significantly reduces the cost and friction of collecting future payments.

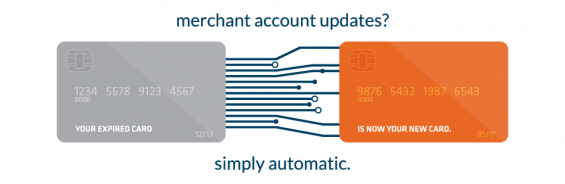

The problem comes about when a card expires or needs to be reissued and the customer has to manually update their payment information across many merchants. Often times, consumers don’t automatically update their account with every merchant they keep cards on file with the moment they get a new card, so the merchant is forced to alert them that their payment information is out of date. This can cause late payments and breaks in service—not ideal for the consumer or the merchant. Furthermore, in the age of convenience, the amount of time it takes to dig in a wallet and enter a new card number can be the difference between you keeping and losing a customer. Expired payment info can serve as an easy excuse to not renew non-essential subscriptions, even if they were happy with the service.

One way around this is of course to request that the consumer allow you to withdraw directly from their bank account, but that creates its own hassles. An easier and more cost-effective way is by using a payment card account updater.

When merchant is enrolls, they are automatically updated with customers’ that have participating cards whenever there is a change, totally eliminating the need to get in touch with the customer and risk losing them over a simple expired card.

When my card data was stolen in December, I had to have my card reissued. I have autopay set up for my AT&T account, and since they use an account updater tool, I didn’t have to lift a finger.

Pretty neat, right?

Here’s how it works:

- Qualified merchants are enrolled through their participating card acquirer.

- The merchant can then either use a tokenization approach and select a date each month to have their gateway provider harvest the card data and run it through the update service, or they can submit their stored cards via API or “batch upload” once a month to have them checked for updates.

- The card issuers then submit electronic files with updates to the card provider whenever a cardholder’s information changes.

- Updates are filed within 2 days of the change.

- Account info can be updated within 5 days of the change. Merchants should either select a harvest date, or submit their stored cards for update at least 5 days prior to their next monthly billing date to ensure there’s no delay in payment in the event of a necessary update.

To learn more about CardConnect’s account updater service, email me directly at tzessin (at) cardconnect.com or visit our contact page.